Sovereign

Leading design thinking to introduce data cleansing and structuring capability to the business. Forming part of a cross-functional working group with the aim of making operation effiency improvements and speed up underwriting workflows.

Role

Design Lead

Project

SaaS Product Design

Year

2024

Avg. Cleansing Time

5m39s

+7% YoY

Time to Quote

3h

-95%

GNWP

100m+

+9% YoY

Context

At Brit Insurance, underwriters relied on unstructured Excel spreadsheets from brokers, filled with inconsistent and incomplete data. This manual, time-intensive process required significant effort to cleanse, structure, and prepare the data for pricing models. These inefficiencies resulted in prolonged quote times, often exceeding two days, leading to delays and missed opportunities in a competitive market.

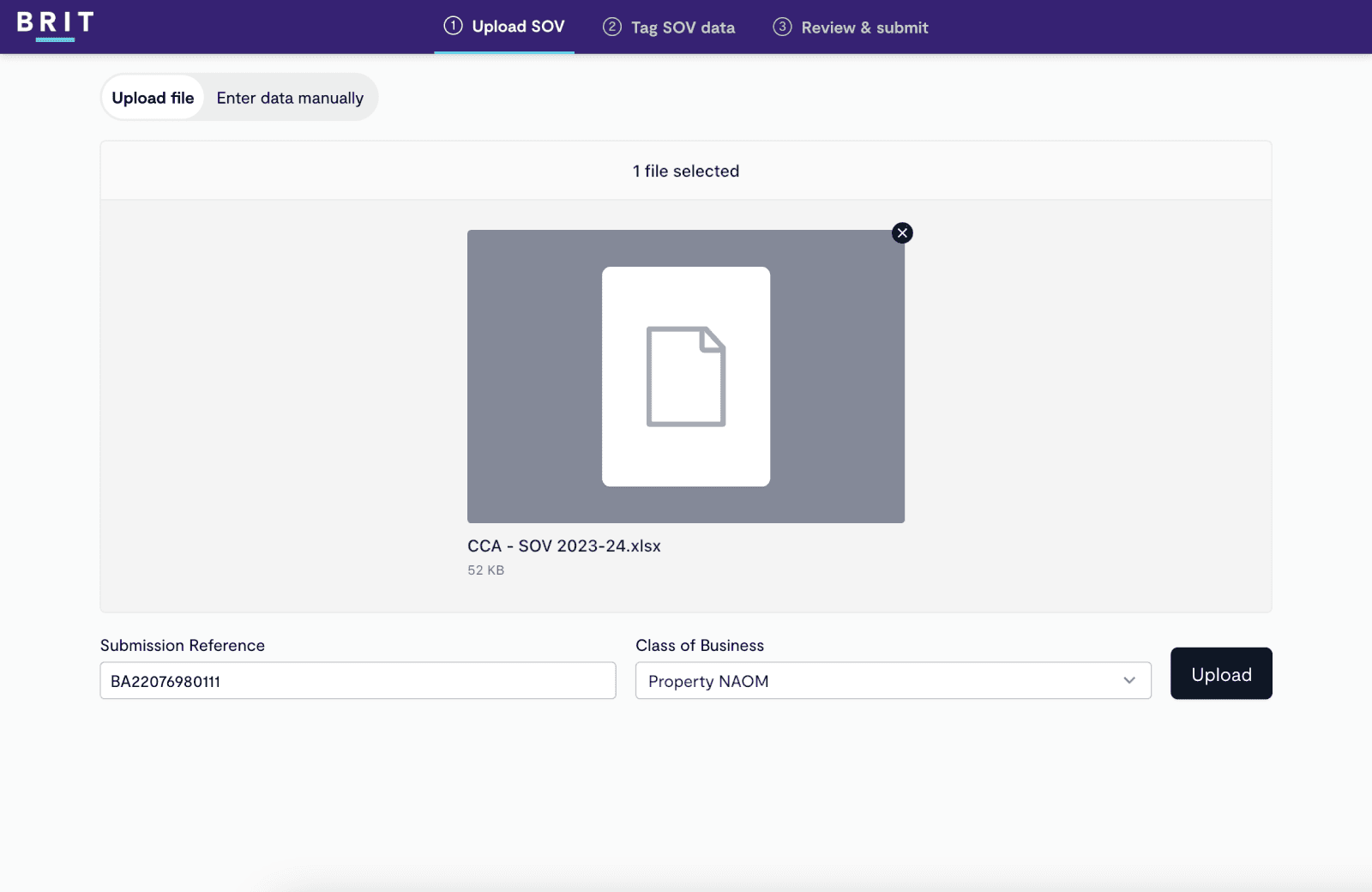

The Sovereign project aimed to revolutionize this process by introducing a seamless product design and development workflow. The goal was to deliver a platform capable of ingesting unstructured Excel documents, cleansing and structuring the data, and enabling risk pricing within hours instead of days.

Approach

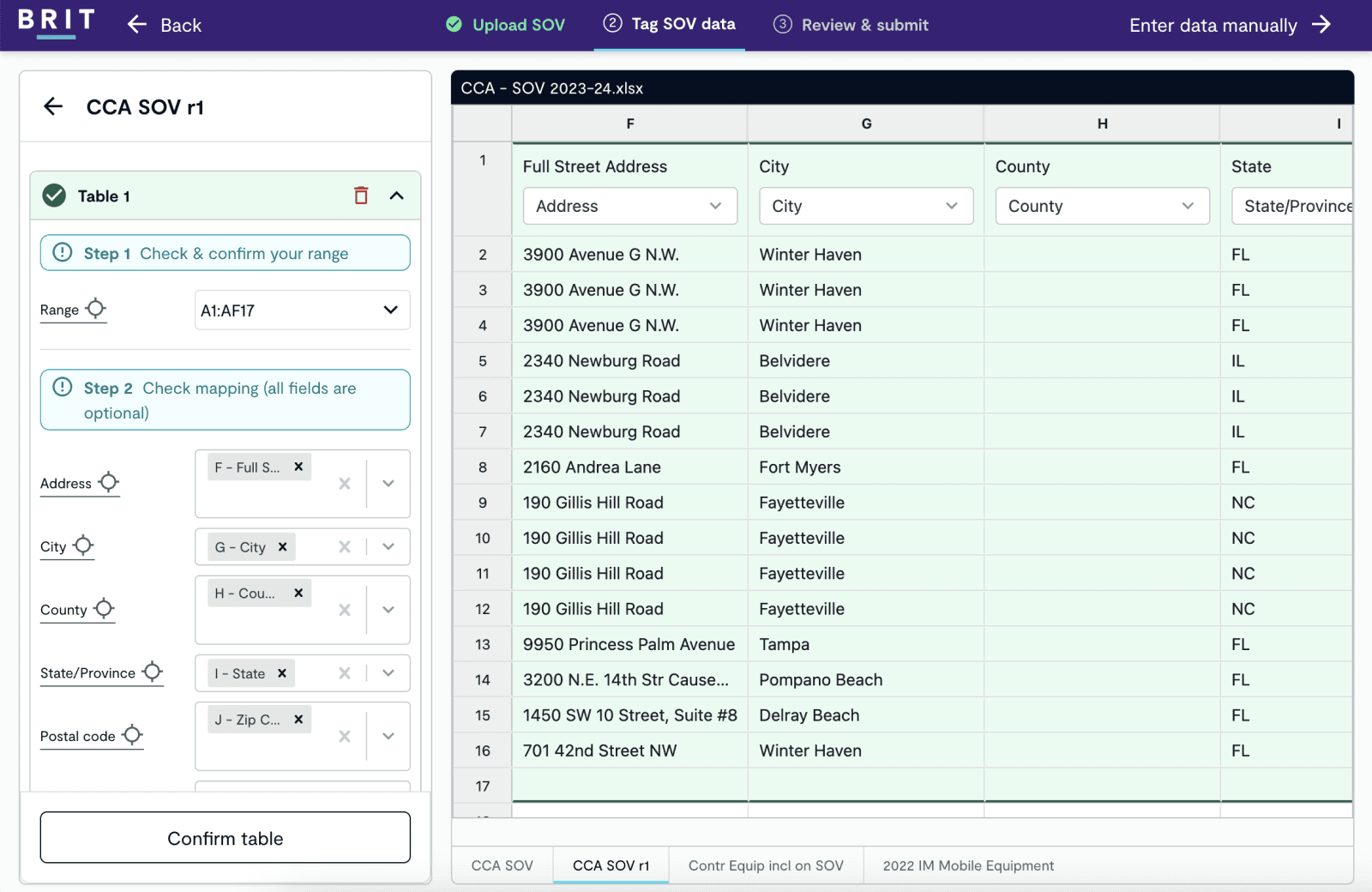

The development of Sovereign was driven by a user-centered and iterative methodology. It began with extensive discovery and research, including interviews with underwriters to identify pain points in the existing submission process. By mapping out workflows, we uncovered key inefficiencies and prioritized features that addressed data accuracy, speed, and usability.

The design strategy involved creating low-fidelity prototypes to conceptualize the new ingestion and data-cleansing workflows. A modular design system was developed to maintain consistency and scalability across the platform, ensuring an intuitive and cohesive user experience. User flows were meticulously designed to simplify the validation and finalization of cleansed data for underwriters.

Collaboration played a critical role in the project. Partnering with data engineers, we integrated machine learning algorithms to automate the data-cleansing process. Throughout the development process, usability testing sessions were conducted with underwriters, providing valuable feedback to refine the interface and address any challenges.

The project was executed in iterative phases, allowing for incremental releases and continuous improvement based on user input. Comprehensive training sessions were conducted to ensure that end-users could effectively adopt and leverage the platform’s capabilities.

Outcome

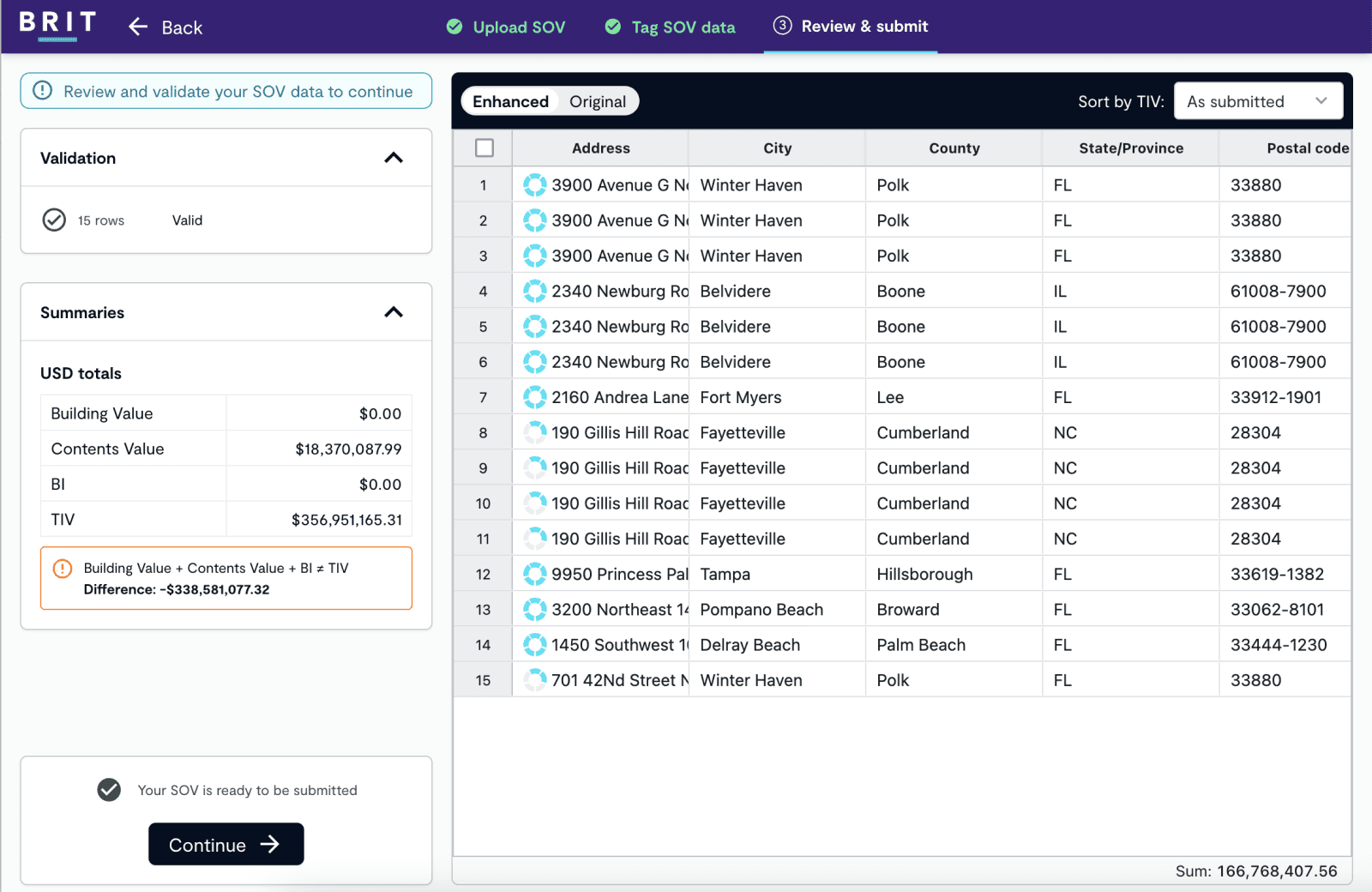

The Sovereign platform achieved transformative results, dramatically enhancing operational efficiency and strategic positioning. It reduced the time required to process and price risks from over two days to just three hours, significantly improving responsiveness and the ability to compete in the market. By automating the cleansing and structuring of data, Sovereign ensured consistent, reliable inputs for pricing models, reducing the risk of manual errors and enabling more accurate underwriting decisions.

Users responded positively to the platform's intuitive interface and time-saving features, highlighting its role in improving day-to-day workflows. Beyond operational benefits, Sovereign positioned Brit Insurance as a leader in technological innovation within the insurance sector, setting a new benchmark for underwriting efficiency.